Kicking off with Real estate pricing trends in major cities, get ready to dive into the exciting world of real estate economics! From bustling metropolitan areas to serene coastal cities, we’ll explore the factors shaping pricing trends and how technology and sustainability play a role.

Overview of Real Estate Pricing Trends in Major Cities

In recent years, real estate pricing trends in major cities have been a topic of interest and concern for many individuals and industries. The fluctuations in prices can be influenced by a variety of factors, including supply and demand dynamics, economic conditions, and market speculation.

Factors Influencing Real Estate Pricing Trends

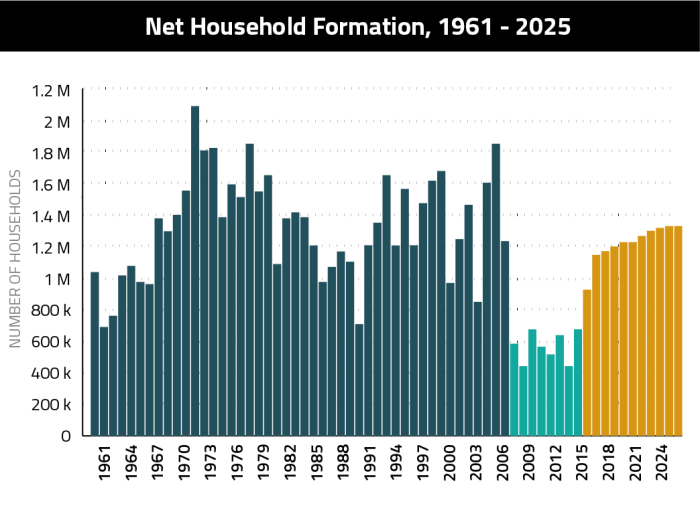

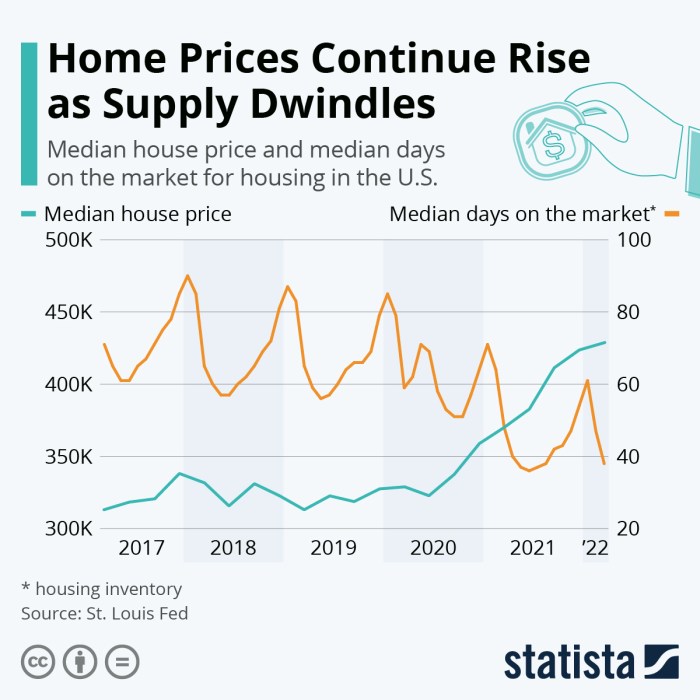

- Supply and Demand: Real estate pricing in major cities is heavily influenced by the balance between the supply of available properties and the demand from potential buyers. When demand exceeds supply, prices tend to increase, and vice versa.

- Economic Conditions: The overall economic health of a city, including factors such as employment rates, GDP growth, and interest rates, can impact real estate pricing trends. A strong economy generally leads to higher prices, while a recession may result in price declines.

- Market Speculation: Speculative activities by investors and developers can also play a significant role in shaping real estate pricing trends. Speculation can lead to price bubbles or sudden price drops, affecting the overall market stability.

Comparison of Pricing Trends in Different Types of Major Cities

Real estate pricing trends can vary significantly between different types of major cities. Metropolitan areas, coastal cities, and inland cities each have unique characteristics that influence their respective pricing trends.

| City Type | Characteristics | Pricing Trends |

|---|---|---|

| Metropolitan Areas | High population density, strong job markets, and diverse amenities. | Generally higher prices due to high demand and limited space for new developments. |

| Coastal Cities | Scenic views, access to beaches, and recreational opportunities. | Prices can fluctuate based on seasonal demand and environmental factors like climate change. |

| Inland Cities | Lower population density, affordability, and potential for urban growth. | Prices may be more stable but can still be influenced by local economic conditions and infrastructure development. |

Impact of Economic Factors on Real Estate Pricing

Real estate pricing trends in major cities are heavily influenced by various economic factors that shape the overall market conditions. These economic indicators play a crucial role in determining the demand and supply dynamics of the real estate sector, thereby impacting property prices.

GDP Growth

- Strong GDP growth typically leads to higher disposable incomes, increased consumer confidence, and greater investments in real estate.

- A booming economy can result in higher demand for properties, leading to an appreciation in real estate prices.

- For example, cities like San Francisco and Seattle experienced significant real estate price increases during periods of robust GDP growth.

Interest Rates

- Fluctuations in interest rates can directly impact the cost of borrowing for homebuyers, influencing their purchasing power.

- Low-interest rates attract more buyers into the market, driving up demand and pushing real estate prices higher.

- Conversely, high-interest rates can deter potential buyers, leading to a decrease in demand and a subsequent decline in property prices.

Employment Rates

- Healthy employment rates indicate a strong job market, which can boost demand for housing as individuals seek accommodation near their workplaces.

- Cities with low unemployment rates often experience a surge in population growth, driving up housing demand and prices.

- During economic downturns or recessions, rising unemployment levels can lead to a decrease in demand for real estate, causing prices to fall.

Global Economic Events

- Global economic events like trade wars, geopolitical tensions, or financial crises can have ripple effects on local real estate markets.

- Uncertainty in global markets can lead to investors seeking safe havens in real estate, driving up property prices in major cities.

- Conversely, economic instability abroad can result in capital flight from real estate markets, causing a decline in property values.

Technological Innovations and Real Estate Pricing

In today’s rapidly evolving real estate market, technological innovations play a crucial role in shaping pricing strategies and consumer behavior. Advancements in AI, virtual reality, and big data analytics have revolutionized how real estate agencies operate and predict pricing trends.

Impact of AI on Real Estate Pricing

AI algorithms have the ability to analyze vast amounts of data to identify patterns and predict future pricing trends. Real estate agencies are leveraging AI-powered tools to generate accurate property valuations, optimize pricing strategies, and anticipate market fluctuations.

Virtual Reality in Real Estate

Virtual reality technology enables potential buyers to take virtual tours of properties from the comfort of their own homes. This immersive experience helps them make informed decisions without physically visiting the property, influencing their perception of pricing and increasing the likelihood of a sale.

Big Data Analytics in Pricing Strategies

Big data analytics allow real estate agencies to analyze market data, consumer preferences, and economic indicators to adjust pricing strategies accordingly. By understanding trends and patterns, agencies can set competitive prices and attract more buyers.

Role of Online Platforms and Apps

Online platforms and apps have transformed how consumers search for properties, compare prices, and interact with real estate agents. These platforms provide real-time market information, virtual tours, and personalized recommendations, influencing consumer behavior and shaping pricing perceptions in the real estate market.

Sustainability Trends in Real Estate Pricing

In recent years, sustainability has become a key factor in determining real estate prices in major cities. With the increasing focus on environmental conservation and energy efficiency, properties with green features are gaining popularity among buyers and investors.Energy-efficient features such as solar panels, smart thermostats, and high-quality insulation can significantly impact property values in urban areas. Not only do these features reduce utility costs for homeowners, but they also contribute to a healthier and more sustainable living environment.Furthermore, properties that have received LEED (Leadership in Energy and Environmental Design) certifications are often perceived as more valuable due to their commitment to sustainable practices.

These certifications not only validate a property’s green credentials but also provide assurance to buyers about the property’s long-term sustainability.

Impact of Energy-Efficient Features on Property Values

- Properties with energy-efficient features command higher prices in major cities due to their lower utility costs and reduced environmental impact.

- Homes with solar panels or geothermal heating systems are particularly sought after for their long-term cost savings and environmental benefits.

- Investing in energy-efficient upgrades can not only increase property values but also attract eco-conscious buyers looking for sustainable living options.

Importance of LEED Certifications in Real Estate

- Properties with LEED certifications are seen as premium real estate investments as they demonstrate a commitment to sustainable building practices.

- LEED-certified buildings often have higher resale values and can command premium rents in the rental market.

- Buyers are willing to pay a premium for properties with LEED certifications due to the added assurance of quality, sustainability, and energy efficiency.

Home Family Home Improvement and Furniture

Real estate pricing trends in major cities have a significant impact on the home improvement and furniture markets. As property values fluctuate, homeowners are often motivated to invest in renovations and updates to increase the value of their homes. Similarly, furniture styles and trends are influenced by the overall real estate pricing dynamics in a region.

Popular Home Improvement Projects

- Kitchen Remodeling: With the kitchen being the heart of the home, investing in modernizing this space can significantly increase property value.

- Bathroom Renovations: Upgrading bathrooms with modern fixtures and finishes can also have a positive impact on home value.

- Outdoor Living Spaces: Creating functional outdoor spaces like patios or decks can enhance the overall appeal of a property.

Furniture Styles Influenced by Real Estate Pricing

- Minimalist Designs: In cities with high real estate prices, minimalist furniture styles are popular as they create a sense of space and modernity.

- Multifunctional Furniture: In smaller homes or condos in expensive cities, multifunctional furniture pieces are sought after to maximize space.

- Sustainable Materials: With the growing focus on sustainability, furniture made from eco-friendly materials is a trend influenced by real estate pricing dynamics.

Tips for Aligning Home Improvement Investments

- Research Market Trends: Stay informed about real estate pricing trends in your city to make informed decisions about home improvement projects.

- Focus on High-ROI Projects: Invest in renovations that have a high return on investment and are aligned with the current market demands.

- Consider Long-Term Value: Choose upgrades that not only enhance your living space but also add value to your property in the long run.

Home Security

The importance of home security in major cities goes hand in hand with real estate pricing trends. As urban areas become more densely populated, the need for secure living spaces becomes increasingly crucial. Homebuyers are willing to pay a premium for properties that offer advanced security features and systems, especially in competitive real estate markets where safety and peace of mind are top priorities.

Impact of Security Features on Property Values

Innovative home security solutions can significantly impact property values and buyer perceptions. Features such as smart locks, security cameras, alarm systems, and motion sensors not only enhance the safety of a property but also increase its market value. In major cities where crime rates can be a concern, homes equipped with state-of-the-art security technology are often more attractive to potential buyers.

- Smart Locks: These keyless entry systems provide convenience and enhanced security by allowing homeowners to control access to their property remotely.

- Security Cameras: Surveillance cameras offer round-the-clock monitoring and deter potential intruders, providing homeowners with an added sense of security.

- Alarm Systems: Advanced alarm systems can alert homeowners and authorities in case of a security breach, ensuring a quick response to emergencies.

- Motion Sensors: Motion-activated lights and sensors can detect movement around the property, deterring trespassers and enhancing overall security.

Real Estate Investment Strategies

Investing in real estate can be a lucrative endeavor, especially when tailored to capitalize on pricing trends in major cities. By strategically diversifying your real estate portfolio across different cities with varying pricing trends, you can mitigate risks and maximize returns. Identifying undervalued properties and predicting future pricing trends are essential skills for successful real estate investors.

Benefits of Diversifying Real Estate Portfolios

Diversifying your real estate portfolio across different cities with varying pricing trends offers several benefits:

- Reduced risk exposure: By spreading your investments across multiple markets, you can minimize the impact of a downturn in any single market.

- Increased potential for higher returns: Investing in cities with different pricing trends can help you capture opportunities for growth and capitalize on market fluctuations.

- Enhanced portfolio resilience: Diversification can help protect your investments against unforeseen events or economic uncertainties.

Tips for Identifying Undervalued Properties

Identifying undervalued properties is crucial for maximizing your real estate investment returns. Here are some tips to help you spot these opportunities:

- Research local market trends and economic indicators to identify areas with potential for growth.

- Look for properties that are priced below market value due to factors like outdated amenities, cosmetic issues, or motivated sellers.

- Consider working with a real estate agent or professional who has expertise in the local market and can help you identify undervalued properties.

Predicting Future Pricing Trends in Major Cities

Predicting future pricing trends in major cities requires a combination of market research, economic analysis, and industry knowledge. Here are some strategies to help you forecast future pricing trends:

- Monitor key economic indicators such as job growth, population growth, and development projects to gauge the health of the local real estate market.

- Stay informed about government policies, zoning regulations, and infrastructure projects that could impact property values in major cities.

- Study historical pricing data and market trends to identify patterns and make informed predictions about future pricing trends.

Final Review

As we wrap up our discussion on real estate pricing trends in major cities, remember to keep an eye on economic factors, technological innovations, and sustainability practices. By understanding these trends, you’ll be better equipped to navigate the dynamic real estate market with confidence.

FAQ Explained

How do economic conditions influence real estate pricing trends?

Economic conditions such as GDP growth and interest rates can impact supply and demand, ultimately affecting real estate prices in major cities.

What role does technology play in predicting real estate pricing trends?

Technological advancements like AI and big data analytics are being used by real estate agencies to forecast pricing trends with greater accuracy.

Why is sustainability becoming increasingly important in real estate pricing?

Sustainability practices and green buildings are gaining importance as they can positively impact property values and long-term appreciation in major cities.